nevada estate tax rate

The common level of appraisal is 7765 which means assessed values are about 78 of true market values. This makes the Washington estate tax one.

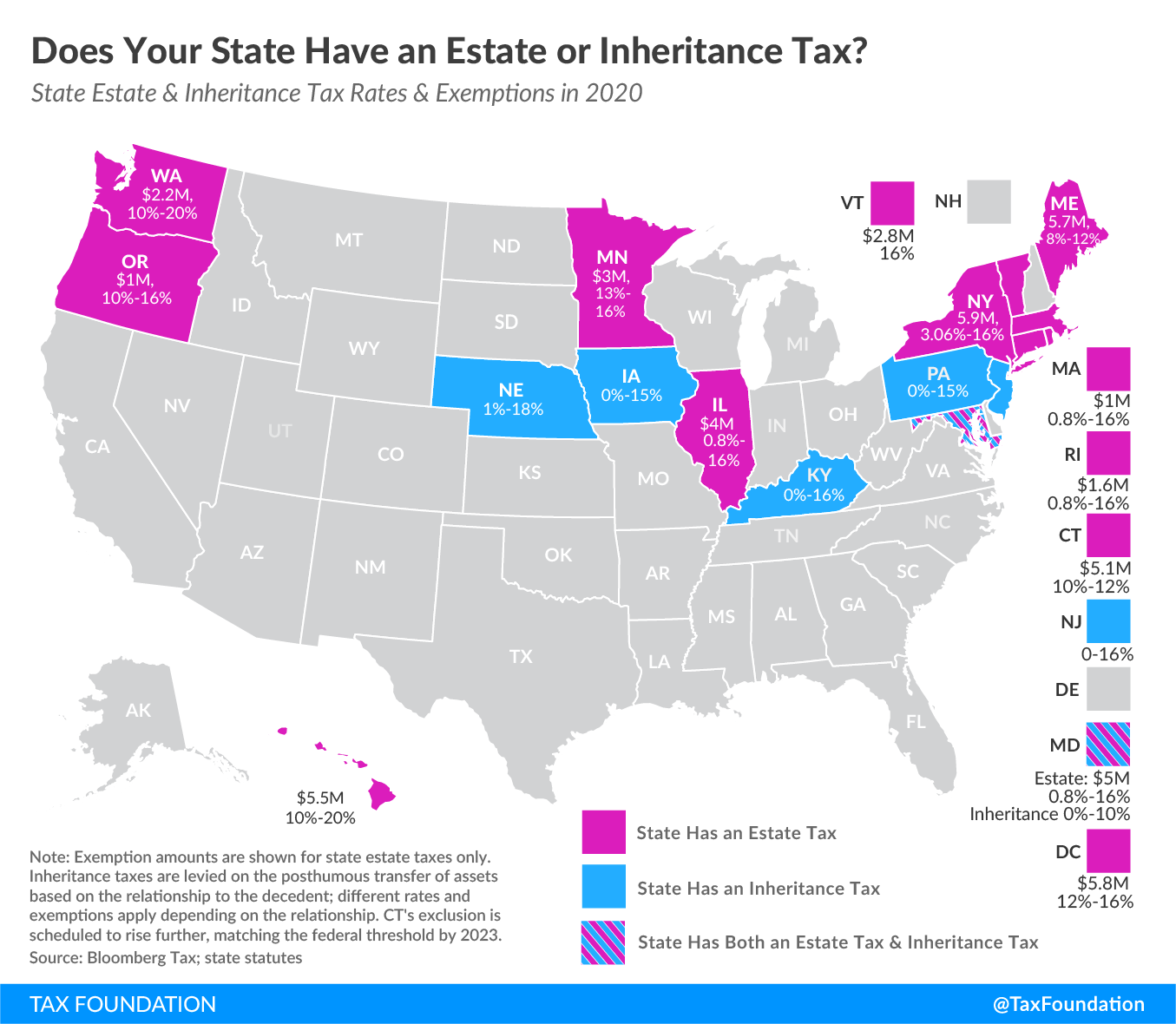

States With No Estate Tax Or Inheritance Tax Plan Where You Die

But a 20 rate is charged for any estates that are over 9 million over the estate tax exemption.

. The first million dollars above the estate tax exemption is taxed at a marginal rate of 10. Groceries prescription drugs and non-prescription drugs are exempt from the New York sales tax. For that reason the total homestead education tax rate is higher in Burlington than in much of the state at about 20576.

In the city of Burlington the total municipal tax rate is 09002 and that applies to assessed value. Use Tax applies to mail order out-of-state toll-free 800 numbers purchases made on the internet and other purchases of tangible personal. The self-employment tax rate for 2020 is 153 of your total taxable income no matter how much money you made.

Federal and state income taxes use a graduated scale to determine how much youll pay. New York has 2158 special sales tax. Counties and cities can charge an additional local sales tax of up to 4875 for a maximum possible combined sales tax of 8875.

The New York state sales tax rate is 4 and the average NY sales tax after local surtaxes is 848. For the most part Use Tax rather than Sales Tax applies to property purchased ex-tax outside of Nevada for storage use or other consumption in Nevada from other than a seller registered in Nevada.

Nevada Tax Advantages Luxury Real Estate Advisors Las Vegas Real Estate

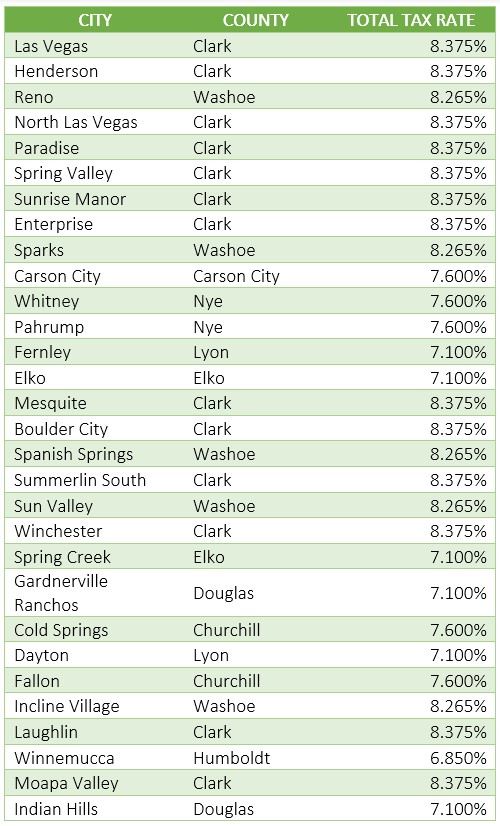

Nevada Sales Tax Guide For Businesses

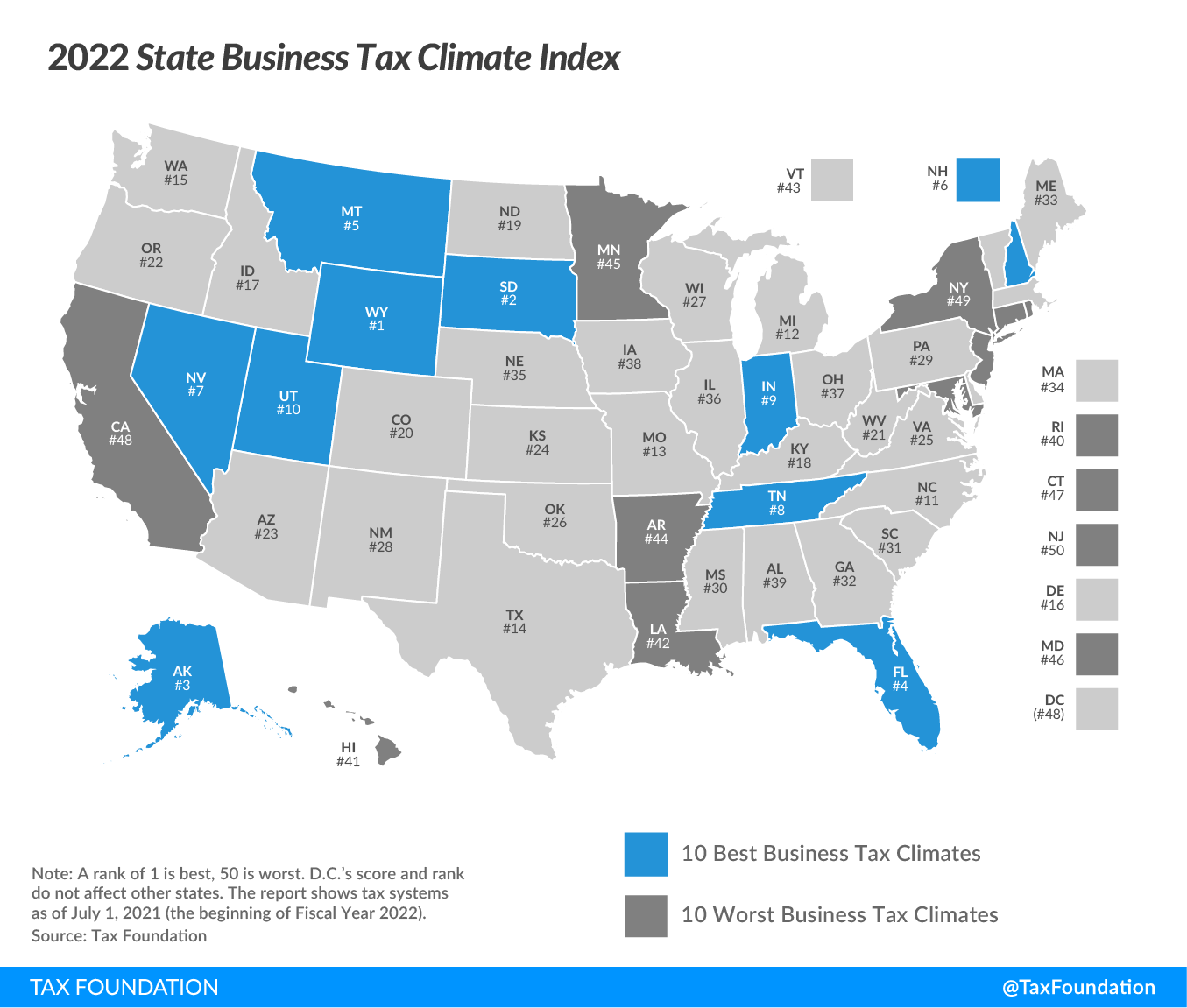

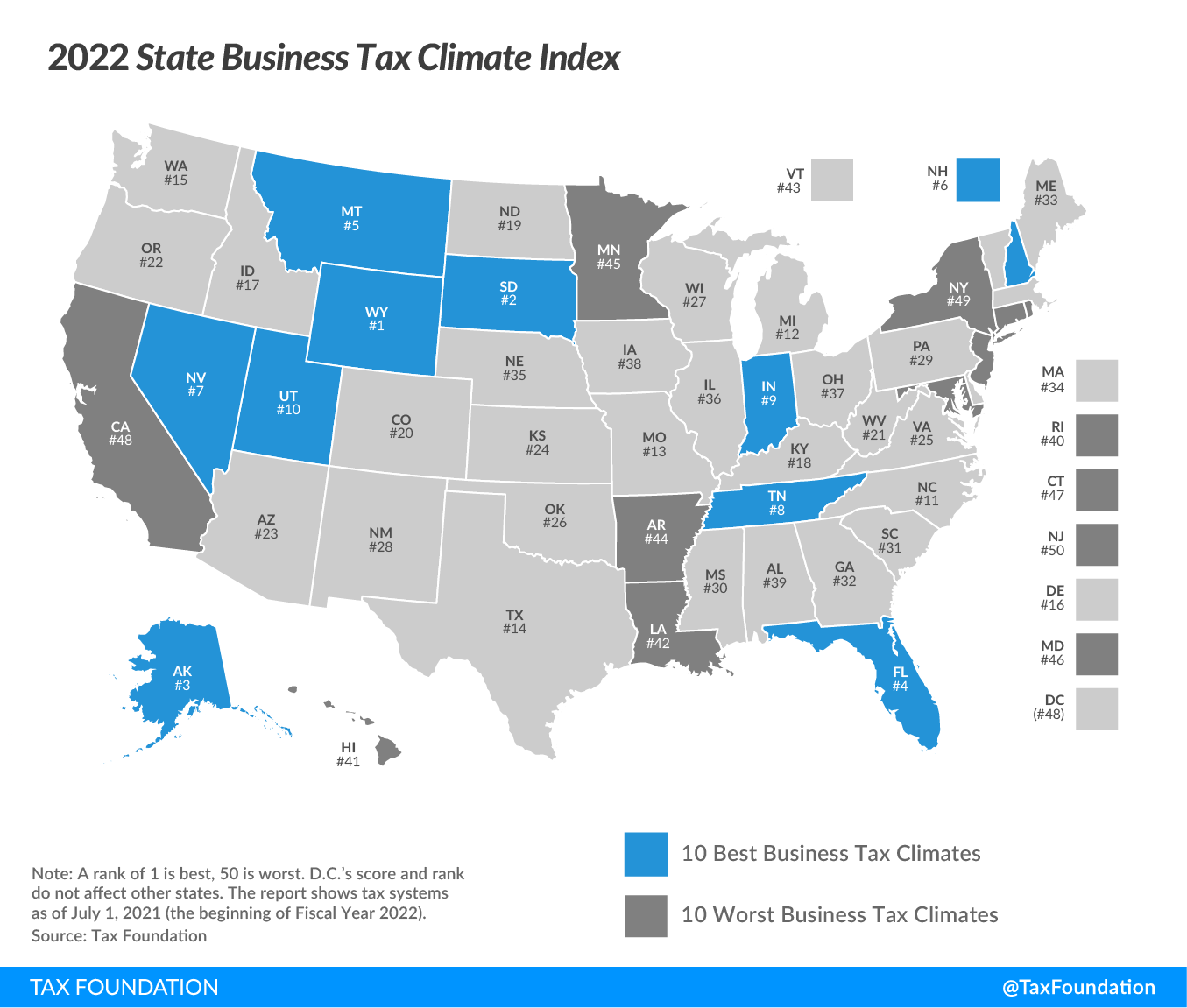

Nevada Tax Rates Rankings Nevada State Taxes Tax Foundation

Taxes In Nevada U S Legal It Group

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

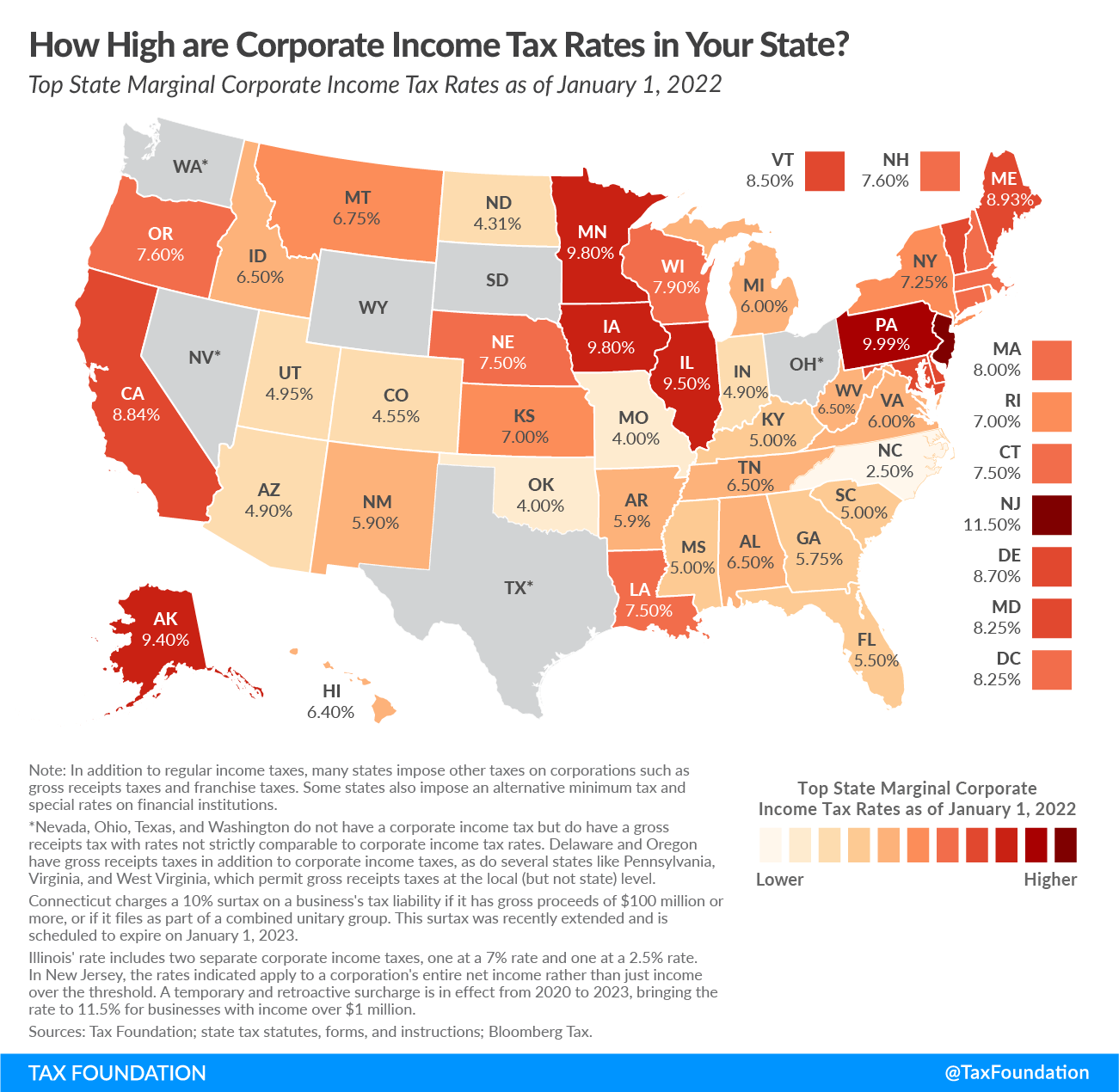

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Nevada Property Tax Calculator Smartasset

Nevada Tax Rates And Benefits Living In Nevada Saves Money

Don T Die In Nebraska How The County Inheritance Tax Works

Nevada Tax Rates And Benefits Living In Nevada Saves Money

Nevada Tax Rates Rankings Nevada State Taxes Tax Foundation

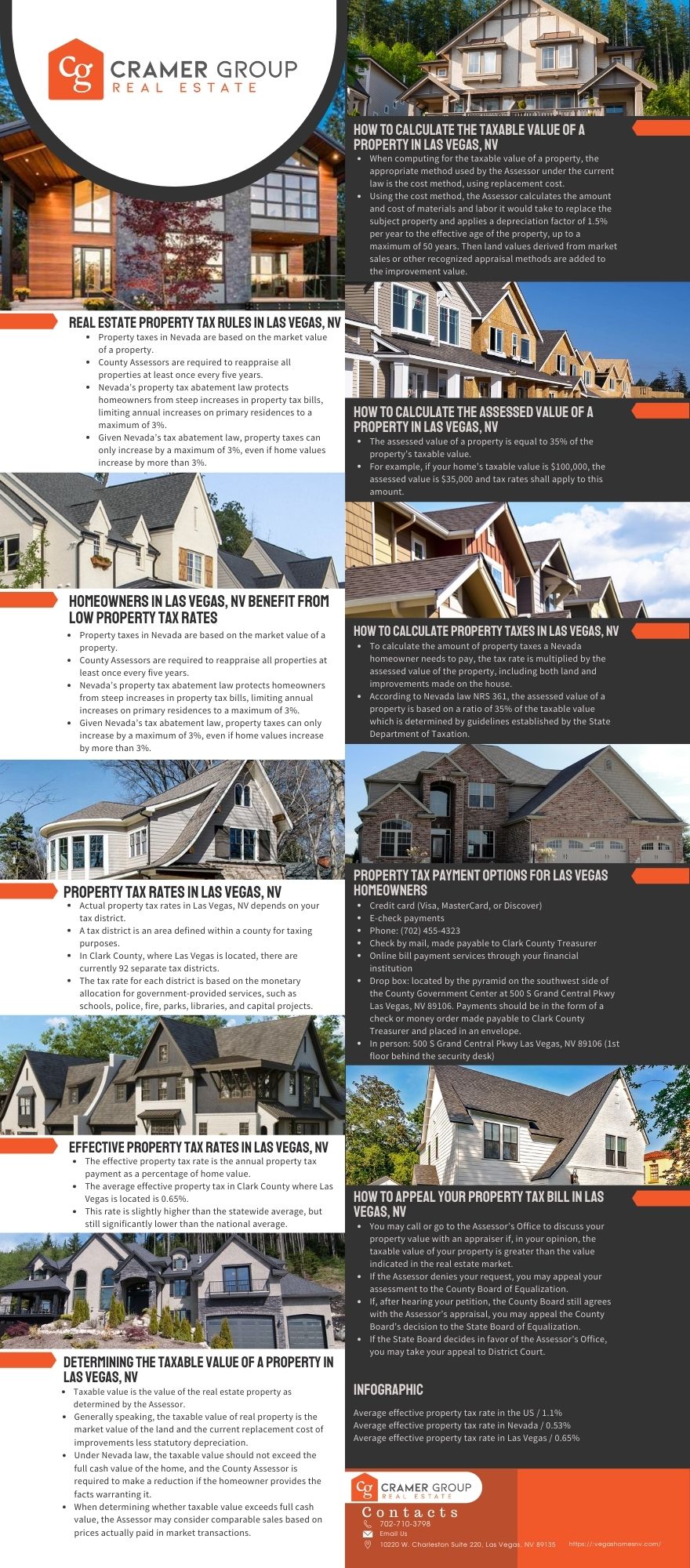

Property Taxes In Las Vegas Nv The Cramer Group At Urban Nest Realty

Nevada Inheritance Laws What You Should Know

Nevada Retirement Tax Friendliness Smartasset

Nevada Tax Rates And Benefits Living In Nevada Saves Money

Taxes In Nevada U S Legal It Group

Nevada Vs California Taxes Explained Retirebetternow Com